eSign Payment Processing

Streamline your business transactions and enhance operational efficiency by seamlessly combining secure eSignatures with integrated payment processing. This powerful combination simplifies workflows and reduces administrative overhead.

Trusted By

Integrated Payment Processing

Easier document management.

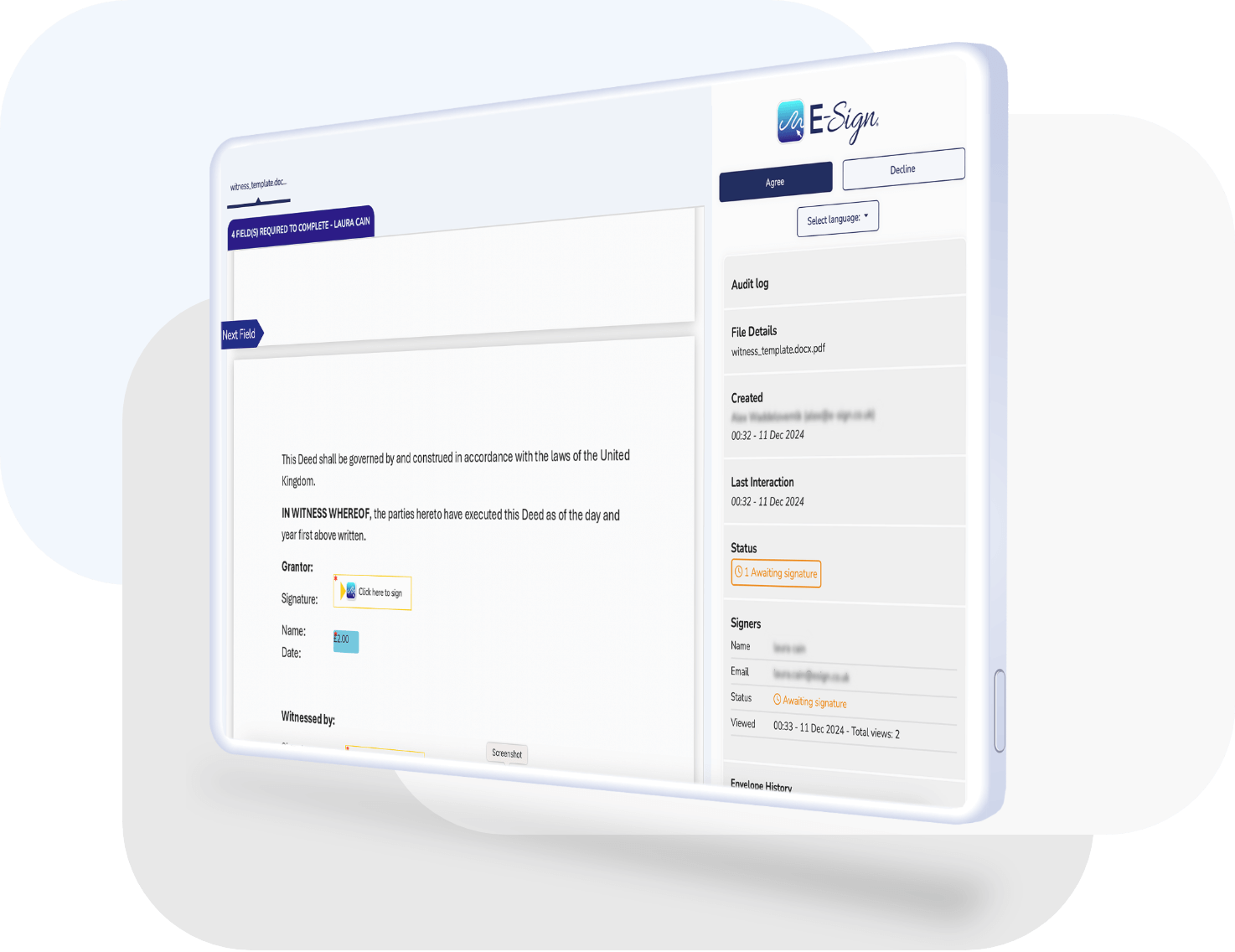

How does eSign’s Payment Capture Work?

Combine two separate transactions into one for easier document management. After connecting your payment gateway to the eSign platform, you can easily add a payment request via our Payment Tags.

eSign accepts major credit cards, debit cards, Apple Pay and Android Pay from your clients. Acceptable payment methods vary with the payment gateway you decide to use:

- Stripe: Credit cards, debit cards, Apple Pay, Android Pay

- Braintree/PayPal: Credit cards, debit cards

- Net: Credit cards, debit cards

Complete transactions instantly and securely.

Streamline and Digitalise Payment Collection

Collect payments and complete transactions instantly and securely with our easy payment processing. Spend less time chasing and manually processing payments and more time growing your business.

With the ability to collect payments directly into your bank account, your business can also benefit from improved accountancy and financial modelling. Collect eSignatures & payments on agreements, including:

- Insurance premiums

- Membership agreements

- Event space rentals

- Donations

- Security deposits

Integrate with Leading Tools

Create bespoke workflows to suit your business with a range of application integrations.

UK Government’s high-performance network.

The Only Trusted Digital Signature Provider on the Public Service Network

E-Sign is the only electronic signature provider trusted on the Public Service Network. The PSN is the UK Government’s high-performance network, which enables public sector organisations to work together, reduce duplication and share resources.

Government organisations and health trusts access the PSN for secure and trusted digital services. Suppliers must meet strict regulatory requirements and the highest security standards to be PSN certified.

With the rapidly growing digitisation of document management and cloud-based solutions, the need for trustworthy providers has never been more important. The eSign platform provides businesses with improved efficiencies and major cost savings, creating enhanced advantages over competitors.

Benefits of Payment Processing

Reduced Errors

Equip your business with real-time audit trails of payment capture and document completions.

More Focus on your Business

Spend less time chasing and manually processing payments and more time on driving your business forward.

Smoother Customer Experience

Deliver a superior customer experience by providing the ability to complete transactions and agreements instantly.

Improved Cash Flow

Get payments transferred directly into your bank account for improved accountancy and financial modelling.

Easy Set up

Our payment capture is easy to set up. All you need to do is link your payment gateway to your eSign account.

Secure Payment Processing

All information is encrypted and securely handled for peace of mind that your transactions are protected.

Featured Industries

Discover eSignature solutions and use cases in your industry.

Healthcare

eSign offers complete digital document solutions for healthcare organisations, streamlining processes, efficient transactions, and cost-effective services.

Learn More

Accountancy & Tax

Digital solutions for accountancy and tax, e-signatures for HMRC documents, book keeping and integrations into leading softwares.

Learn More

Legal

Streamline document turnaround and completion, increase compliance and elevate contract reviews with a digital document management solution.

Learn More

Education

eSign offers digital solutions for educational organisations, from student enrolment, financial aid documents, HR documents and more.

Learn More

Finance

Digitise key financial agreements and workflows, do business faster and eliminate slow manual processes with an electronic signature.

Learn More

Discover more industries

eSign provides digital solutions for organisations and individuals across all industries.

Learn More

Technical Checklist

- Choose your preferred payment gateway for integration into eSign’s platform.

- Easily add Payment Tags to your documents to collect payments when closing transactions.

- Benefit from improved cashflow and financial modelling.

- Improve your overall customer experience with easy payment options.

- Integrate two separate processes into one simple transaction.

- Spend less time chasing and manually processing payments.

eSign Case Studies

National Clinical Homecare Association

The healthcare industry clearly recognised the need to adopt a digital approach to prescription processing, giving operational advantages, regulatory compliance and improvements to patient safety.

Mid Devon District Council

There has been significant time and cost savings on the sign-up process for new tenants as there is no longer a requirement for officers or tenants to travel to meet in a location to sign the agreement.

University Hospitals Leicester

The E-Sign implementation has achieved demonstrable improvements in service efficiency, supported cross-site working and reduced costs for the UHL Kidney Pharmacy home delivery services.

CHOOSE YOUR TEMPLATE TO SUIT YOUR BUSINESS NEEDS

Templates

eSign templates simplify document signing for your business, saving time and resources. Easily integrate electronic signatures into your workflow, whether it’s contracts, agreements, or other legal documents.

Frequently Asked Questions

What does Payment Processing mean?

Payment processing refers to the secure collection of payments from customers using our instant payment processing solution. With this feature, your clients can conveniently electronically sign documents and complete payments in a seamless single transaction.

Can Payment Processing Save you Time?

Payment processing systems streamline the payment collection process, reducing the time required to handle transactions and improving overall efficiency.

Does payment processing increase cash flow whilst saving costs?

Prompt payment processing enables businesses to receive funds quickly, improving cash flow and providing greater financial stability. In addition labour costs are reduced. By automating payment processing tasks, businesses can reduce manual labor requirements, resulting in lower labor costs and increased productivity.

Can Payment Processing Improve Customer Experience?

Customer satisfaction is improved customer, efficient payment processing ensures smooth and hassle-free transactions for customers, enhancing their overall experience and satisfaction with your business.

Is Payment Processing Scalable?

Payment processing solutions can scale with your business as it grows, accommodating higher transaction volumes and expanding payment options to meet evolving customer needs.

What is the role of Payment Processing?

Payment processing plays a crucial role in managing debit/credit card transactions. Acting as a mediator between merchants and financial institutions, the payment processor authorises these transactions and facilitates the timely transfer of funds, ensuring that merchants receive their payments promptly. By handling the transaction process, payment processors enable seamless and secure payment experiences for both merchants and customers.

Can Payment Processing Reduce Errors?

Automated payment processing minimises the risk of human error in data entry, calculation, and reconciliation, leading to more accurate financial records.

Is Payment Processing Secure?

Enhanced Security: Payment processing systems incorporate robust security measures, protecting sensitive payment information and reducing the risk of fraudulent activities.

Does Payment Processing Simplify Reconciliation?

Simplified Reconciliation: Payment processing systems provide detailed transaction records and reports, simplifying the reconciliation process and making it easier to track and manage financial data.

What are the Main Benefits of Payment Processing?

Overall, the benefits of payment processing include time savings, reduced human error, improved cash flow, lower labor costs, enhanced security, customer satisfaction, simplified reconciliation, and scalability, all of which contribute to greater operational efficiency and financial success.